According to a recent survey from The Harris Poll commissioned by Express Employment Professionals, Job seekers’ and employees’ desire for flexibility has upended the workforce, and while the majority of both groups don’t believe that 1099 employment is simply a fad (66% job seekers and 58% hiring managers), more than 7 in 10 believe it will never replace traditional employment (72% and 75%, respectively).

Despite signaling plans to hire full-time staff, companies appear to have a growing interest in alternative hires. Nearly 3 in 10 (29%) are planning to hire seasonal, temporary or contract workers. This intention aligns with the trends observed in the second half of 2022, where 28% of companies expressed similar hiring plans.

Currently, nearly half of U.S. hiring managers (47%) say their businesses employ 1099 workers, and 29% do not currently but have done so in the past. Only 24% say they’ve never employed 1099 workers.

1099 workers, also known as independent contractors or gig workers, are self-employed individuals or freelancers who are hired by businesses on a project basis. They receive payment for their services and are responsible for handling their own taxes, including income and self-employment taxes.

W-2 workers, on the other hand, are considered employees of a company, and their employer withholds income taxes, Social Security and Medicare taxes from their paychecks. They could also be eligible for certain benefits.

Among companies that employ 1099 workers, hiring managers say 38% of the company’s production or work, on average, is completed by such workers. Nearly three-quarters of hiring managers whose companies use 1099 workers (73%) report doing so when they aren’t able to fill open positions with full-time employees.

Disadvantages of 1099 Employment

While companies appear drawn to the flexibility of utilizing 1099 workers, employees may be similarly inclined. More than 2 in 5 hiring managers (45%) are concerned their company will lose employees to 1099 opportunities. In addition, companies report that over the past two years they have already lost 23% of their employees, on average, to this type of work.

However, in a similar survey conducted by The Harris Poll, respondents conceded there are disadvantages to the 1099 classification vs. W-2 status, such as:

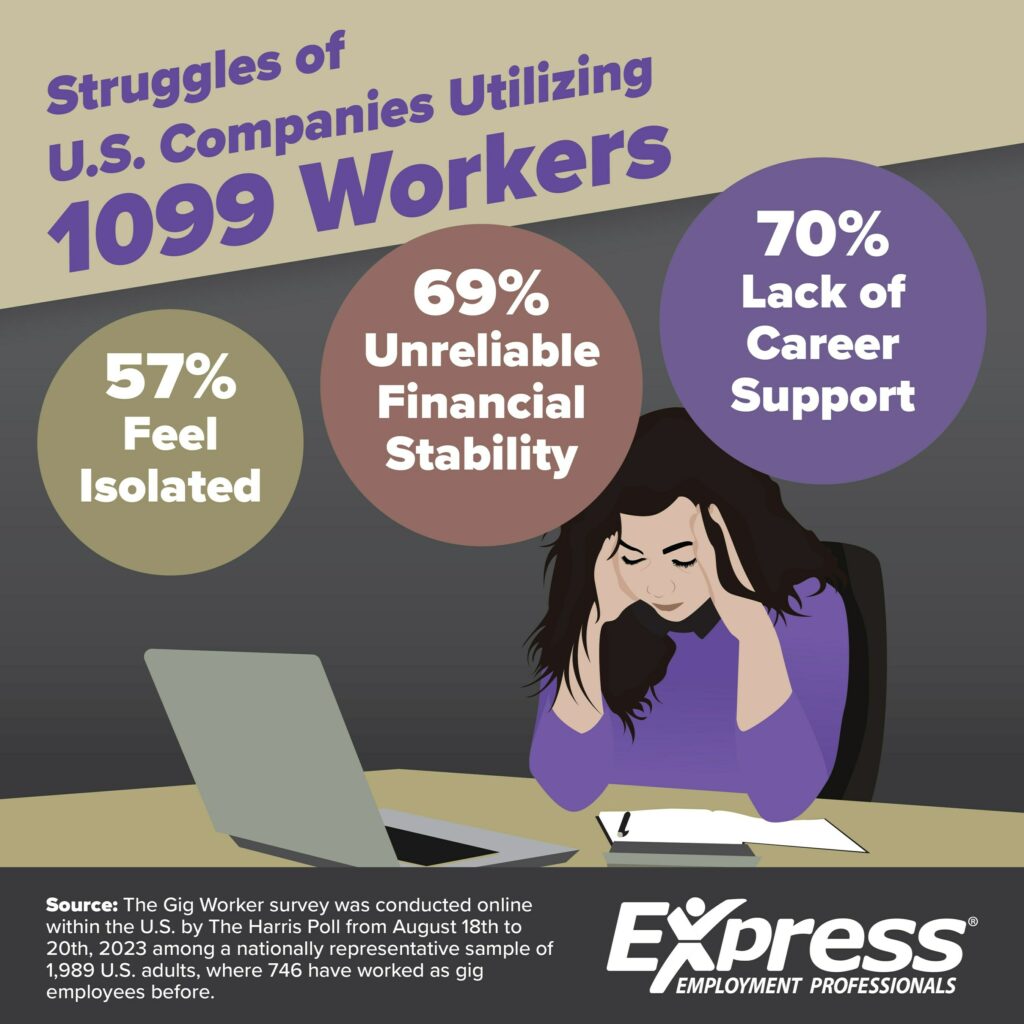

- Lack of career support as a gig employee: 70%

- An unreliable means for long-term financial stability: 69%

- Less leverage as a gig employee than traditional W-2 employee: 65%

- Lack of proper compensation: 61%

- Feeling isolated as a gig worker compared to traditional W-2 employee: 57%

- Don’t have the means to develop skills as a gig employee: 46%

“W-2 work provides the perfect blend of flexibility and security, allowing individuals to pursue their passions while enjoying the stability of traditional employment,” said Bill Stoller, Express Employment International CEO. “It fosters a sense of unity and belonging, making employees feel like valued members of a team rather than solitary contributors, and allows them to experience the camaraderie and shared purpose that comes with working alongside colleagues in a supportive organization.”